At RMS and associated firms, business continues as usual. Our staff is remote-capable and available to handle all partners, brokers, and insureds at the present time.

Contact us today!

Executive Order for Policyholder Payments

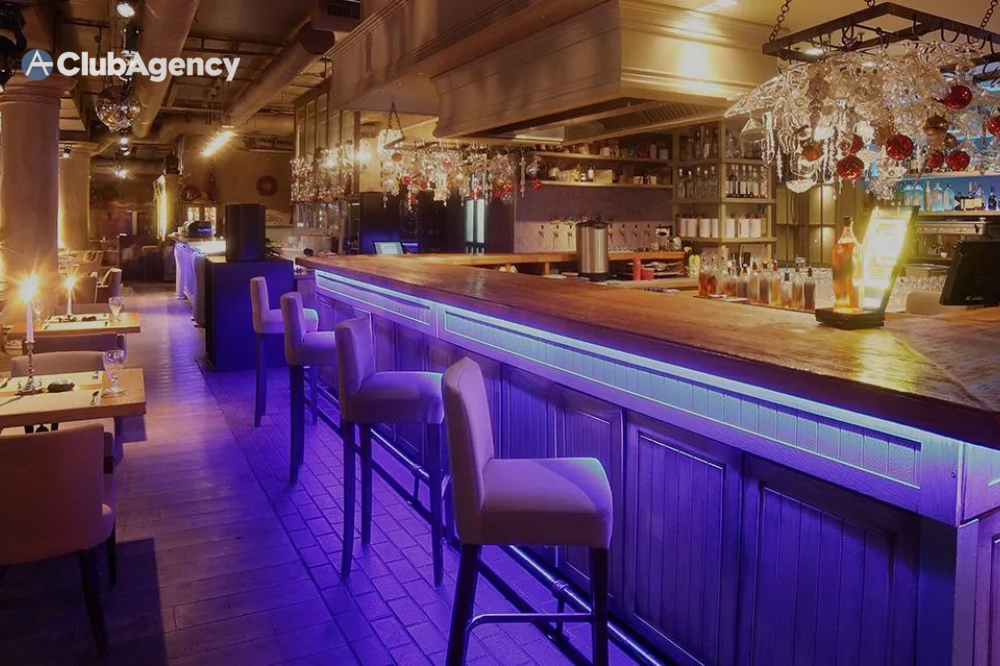

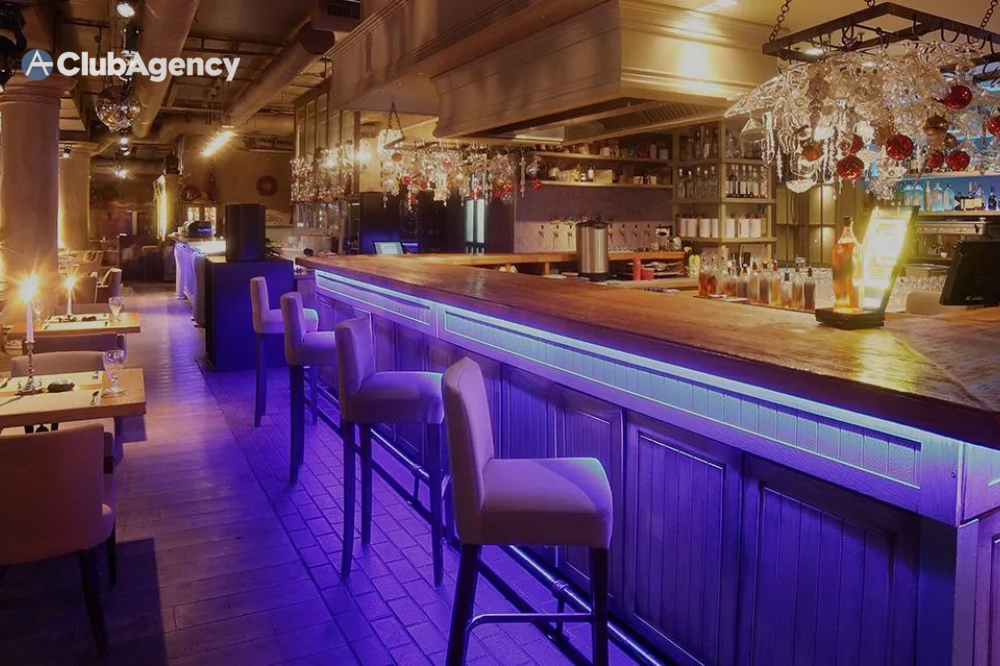

In the dynamic hospitality industry landscape, unforeseen challenges are part and parcel of the journey. Businesses in this sector are exposed to many risks, from bustling hotels to cozy beds and breakfasts. This is where hospitality insurance acts as a shield, offering protection against the unpredictable. In this blog post, we'll delve into hospitality insurance's intricacies and explore its diverse coverage.

Hospitality insurance is a comprehensive coverage designed specifically for businesses in the hospitality sector. It goes beyond standard business insurance to address the unique challenges hotels, restaurants, and other similar establishments face. The goal is to provide a safety net that ensures these businesses can thrive despite possible uncertainties.

Hospitality businesses invest significantly in property, from buildings to furnishings. Property insurance covers damages to these assets caused by unforeseen events such as fire, theft, or natural disasters. This type of insurance ensures the business can recover and rebuild without bearing the entire financial burden.

In the hospitality industry, customer interactions are frequent, and accidents can happen. Liability insurance protects businesses from legal claims arising from bodily injury or property damage on the premises. This coverage is crucial for safeguarding the business's financial stability in the face of unexpected legal challenges.

The financial repercussions can be severe when unexpected events force a business to close temporarily. Business interruption insurance provides coverage for lost income during these periods of closure. Whether it's due to a natural disaster or other unforeseen circumstances, this insurance helps businesses stay afloat during challenging times.

Hospitality insurance provides a safety net, ensuring businesses do not face financial ruin due to unexpected events. This security lets owners focus on providing exceptional service without worrying about the what-ifs.

The hospitality industry is susceptible to legal challenges. Hospitality insurance acts as a shield, covering legal expenses and settlements in case of lawsuits. This protection is invaluable in maintaining the business's reputation and financial standing.

Knowing that your business is adequately covered brings mental peace. It allows you to focus on the day-to-day operations, growth, and guest satisfaction, knowing that you are prepared for any challenges that may come your way.

In the ever-evolving hospitality industry, uncertainties are inevitable. The key to sustained success lies in being prepared. With its comprehensive coverage, hospitality insurance provides businesses with the resilience needed to navigate challenges. Contact us today and protect your passion and experience the protection with robust hospitality insurance at Club Agency. You can also call us directly at (866) 784-9785.