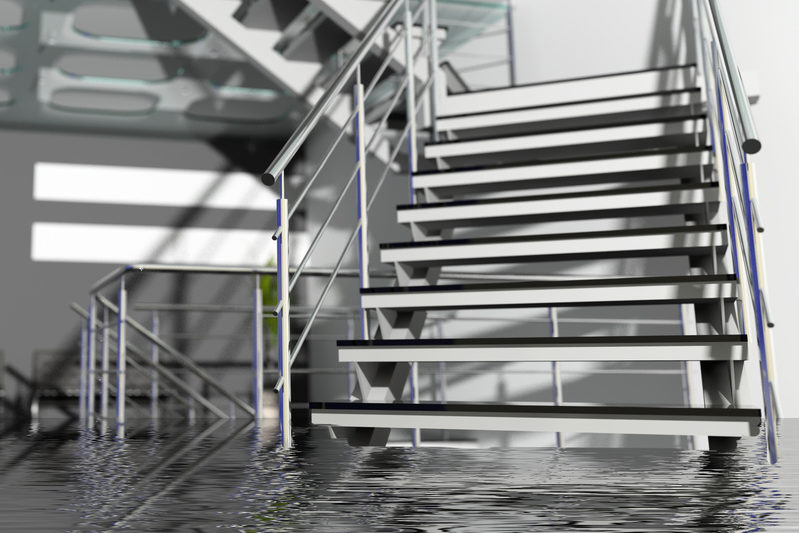

Flooding is the most common natural disaster in the United States, make sure that your business is protected.

Did you know that commercial property insurance policies don't typically cover flood damages? While commercial property insurance generally covers the damage caused by wind or lightening, you need a special policy to protect your business from flooding. Flood insurance protects against flooding that results from overflowing bodies of water, prolonged storms, broken dams, blocked storms drains, and so on.

In certain areas where there is a high flood risk, flood insurance is a required policy. However, for businesses outside of prime flood zones, flood insurance is optional and subject to the discretion of the business owner. While many business owners outside of high flood risk locations may think flood insurance unimportant, they should still consider the risks that come with not being protected. According to the

NFIP (National Flood Insurance Program), a single inch of water can cause over $20,000 of damage. Additionally, it is important to consider that flooding is not always caused by inclement weather. This is reflected by the fact that over 20% of flood claims come from properties that are located outside of areas that experience high flood risk.

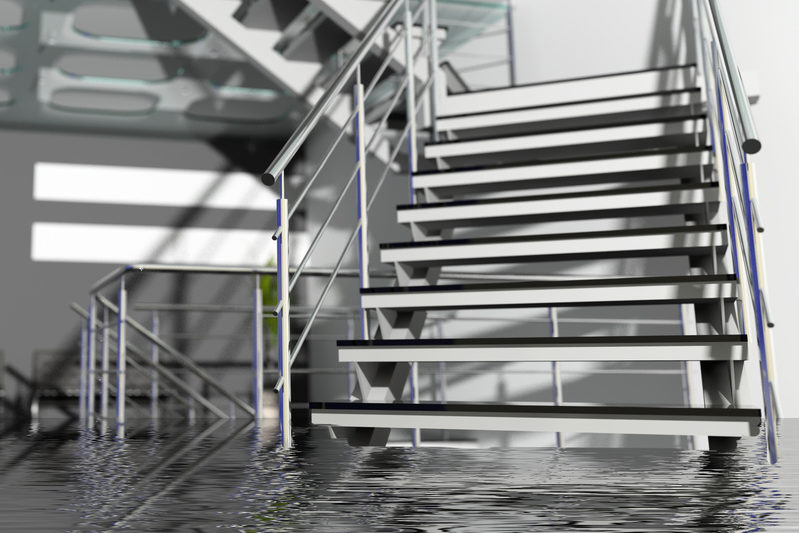

As a business owner, it is important to understand the pros and cons of flood insurance. Start by evaluating your risk for natural flooding. Examine your state's flooding history and determine if you are located in an area with a history of flood damage. Consider your proximity to levees, dams, and other bodies of water that could overflow. Be sure to take the location of mountains into account as snow melt can also result in flooding.

For advice on flooding insurance and for questions about your business insurance,

contact Club Agency Insurance Brokerage in Garden City, New York and make sure you're covered today.